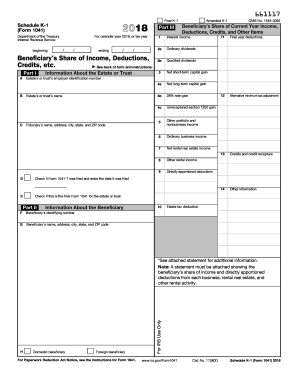

Schedule K-1 2024 Form – Schedule K-1 (Form 1041) is used to report a beneficiary’s share of an estate or trust, including income as well as credits, deductions and profits. A K-1 tax form inheritance statement must be . This form is then used to prepare each Schedule K-1 for the partnership’s owners to claim their share of the partnership’s income and loss on their individual tax returns. Form 1065 is the .

Schedule K-1 2024 Form

Source : schedule-k-1.pdffiller.comWhat is a Schedule K 1 Tax Form? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com2023 Form IRS 1041 Schedule K 1 Fill Online, Printable, Fillable

Source : 1041-k-1.pdffiller.comSchedule K 1 Tax Form for Partnerships: What to Know to File

Source : www.bench.co2019 2024 Form KY 765 Schedule K 1 Fill Online, Printable

What is a Schedule K 1 Form 1041: Estates and Trusts? TurboTax

Source : turbotax.intuit.comIRS 1065 Schedule K 1 2020 2024 Fill out Tax Template Online

Source : www.uslegalforms.comSchedule K 1 1041 2018 2024 Form Fill Out and Sign Printable PDF

Source : www.signnow.comCA Schedule K 1 (565) 2021 2024 Fill and Sign Printable Template

Source : www.uslegalforms.comSchedule K 1 Tax Form for Partnerships: What to Know to File

Source : www.bench.coSchedule K-1 2024 Form 2023 Form IRS 1065 Schedule K 1 Fill Online, Printable, Fillable : Schedule K-1 (Form 1065) If you receive income from a partnership, the IRS will send you schedule K-1 every tax year. You do not return this form to the IRS. Instead, you use schedule K-1 as a . Learn more about the benefits of creating an IRS account online and how the registration process works. For additional tax info, here’s everything you need to know about 2024’s ta .

]]>

More Stories

Baby Yoda Funny Meme 2024 Calendar

Bicycle Day 2024

Psg Game Schedule 2024